Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Buying a home is one of the most significant financial decisions you’ll ever make. Whether you’re a first-time homebuyer or looking to refinance your current mortgage, a mortgage calculator is an essential tool that simplifies the complex process of determining how much you can afford. In this guide, we will walk you through how a mortgage calculator works, why it’s so important, and how to use it effectively.

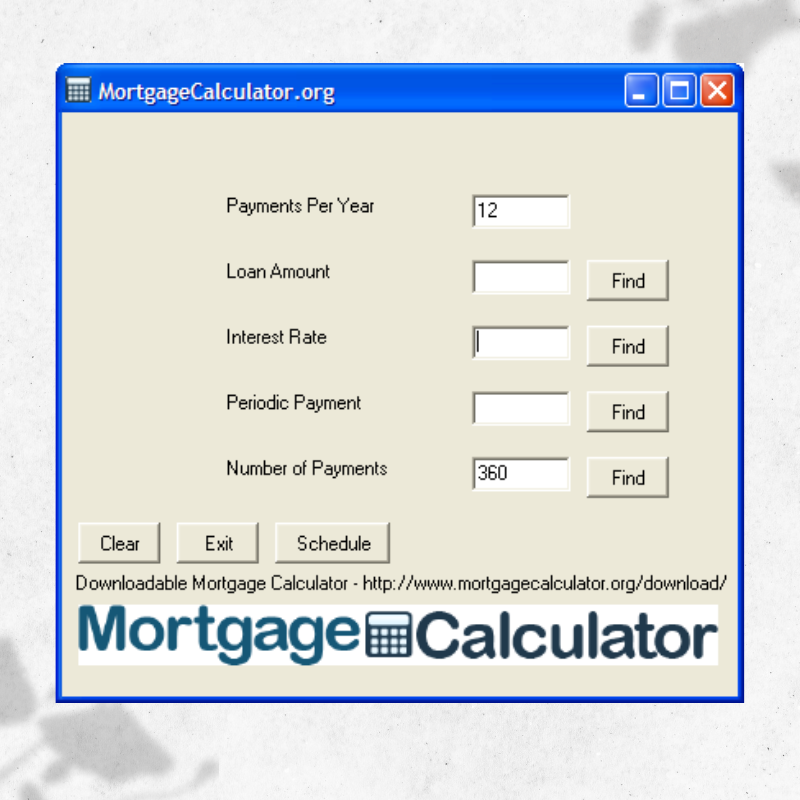

Image source – https://www.mortgagecalculator.org

A mortgage calculator is a financial tool designed to help you estimate your monthly mortgage payments based on your loan amount, interest rate, and loan term. By inputting some key details about your loan and property, you can get a clear picture of how much you’ll need to budget each month for your home loan.

Navigating the home buying process can feel overwhelming, especially when you’re trying to figure out how much you can afford. A mortgage calculator simplifies this by giving you an accurate estimate of your monthly payment, helping you plan your finances better and avoid any surprises.

A mortgage calculator helps you break down your loan into manageable monthly payments. By understanding how much you’ll be paying each month, you can plan your budget and determine whether you can comfortably afford your dream home.

When shopping for a mortgage, it’s crucial to compare different loan options. A mortgage calculator allows you to see how various interest rates, loan terms, and down payments impact your monthly payments, so you can choose the best loan for your situation.

Budgeting is key when buying a home. Using a mortgage calculator lets you understand not only your monthly payments but also the total cost of the loan, including interest over time. This helps ensure you’re not overextending yourself financially.

To use a mortgage calculator, you need three essential pieces of information:

Amortization refers to how your loan is paid off over time. Mortgage calculators show you a breakdown of how much of your payment goes toward interest versus paying off the principal loan amount. This is especially helpful for seeing how much you owe after a certain period.

A larger down payment reduces the loan amount and lowers your monthly payments. A mortgage calculator helps you understand how different down payments affect your loan, enabling you to decide on the right amount to put down.

This is the most commonly used mortgage calculator, providing a quick estimate of your monthly payments based on the loan amount, interest rate, and loan term.

For interest-only loans, this calculator helps you determine the monthly payment, which is lower during the interest-only period.

If you have an adjustable-rate mortgage, this calculator helps you estimate your payments based on the current interest rate, as well as potential future rate adjustments.

An FHA loan is a government-backed mortgage with more flexible terms. This calculator helps you understand how much your FHA mortgage payments will be.

A VA loan is a mortgage for veterans with benefits like no down payment. This calculator helps you estimate your monthly payments based on VA loan terms.

Once you’ve entered all the necessary information, the calculator will display your estimated monthly payment. It will also show you how much of your payment goes toward interest and how much goes toward paying down the principal.

The interest rate is a significant factor in determining your mortgage payment. Higher interest rates mean higher monthly payments. Mortgage calculators allow you to see how small changes in interest rates can affect your loan.

A longer loan term (e.g., 30 years) will result in smaller monthly payments, while a shorter loan term (e.g., 15 years) will have higher monthly payments but save you money on interest.

Don’t forget about property taxes and insurance. Many mortgage calculators allow you to include these additional costs to get a complete picture of your monthly payments.

Make sure the figures you’re entering are accurate. Even a small error in the interest rate or loan amount can lead to incorrect results.

Don’t forget to include additional costs like property taxes, insurance, and HOA fees. These can add up and affect your total monthly payment.

Play around with different loan terms, down payments, and interest rates to find the mortgage option that best fits your budget.

Refinancing can save you money if interest rates have dropped since you took out your mortgage. A mortgage calculator can help you determine whether refinancing is a good option by showing you your new monthly payment and total savings.

Refinance calculators are designed to help you calculate your new loan payment based on the new loan amount, interest rate, and loan term.

Refinancing can reduce your monthly payments and save you thousands of dollars in interest over the life of your loan. It can also shorten your loan term, allowing you to pay off your mortgage faster.

First-time buyers often struggle with determining how much home they can afford. A mortgage calculator provides clarity, helping you avoid overextending your budget.

By showing you how different loan terms and interest rates affect your monthly payment, mortgage calculators ensure that you don’t take on more than you can handle.

A mortgage calculator allows you to compare various loan options side-by-side, helping you make the best financial decision for your situation.

Many people overlook property taxes and insurance when calculating their monthly mortgage payment. Be sure to include these costs to get an accurate estimate.

Interest rates can vary, so make sure you’re using the most up-to-date rate when calculating your payments.

Closing costs can add thousands of dollars to the cost of your home. Some mortgage calculators allow you to estimate these costs as well.

For investment properties, it’s essential to understand cash flow. A mortgage calculator helps you see how much you’ll make in rental income versus your mortgage and other expenses.

A mortgage calculator can also help you calculate your return on investment (ROI) by comparing the income from the property to your mortgage payments and other costs.

In conclusion, a mortgage calculator is an indispensable tool for anyone looking to buy a home or refinance an existing loan. It simplifies the complex process of calculating monthly payments, comparing loan options, and planning your budget. Whether you’re a first-time homebuyer or an experienced investor, using a mortgage calculator will empower you to make informed decisions and take control of your financial future.

Mortgage calculators provide estimates, but for precise numbers, it’s best to consult with a lender.

Yes, mortgage calculators can compare the costs of fixed-rate versus adjustable-rate mortgages to help you choose the best option.

Many mortgage calculators allow you to add property taxes and insurance to your calculations for a more accurate monthly payment estimate.

Yes, some mortgage calculators offer an option to estimate how much you could save by paying off your loan early.

Use a mortgage calculator whenever you’re considering changes to your loan, whether you’re buying a home, refinancing, or exploring new loan options.

Read more – A Comprehensive Guide for Real Estate Buyers